Did you know?

According to Boston Consulting Group, software spending has surged from 13% to 21% within IT budgets between 2019 and 2025.

A massive contributor to this has been the explosion in SaaS adoption. In the current day, SaaS is no longer a side expense…it’s a core operational dependency.

What Does The Explosion in SaaS Adoption Mean?

With the growing use of SaaS comes a tangled web of vendors, pricing models, and hidden dependencies. Procurement teams are overwhelmed, and risk managers are asking:

“What happens if one of our critical SaaS vendors fails, gets acquired, or changes terms overnight?”

Are You Prepared For SaaS Supplier Disruption?

If a company’s SaaS provider experiences a disruption or collapse, the business could instantly find itself in jeopardy, potentially losing access to vital cloud-based applications like financial systems and HR platforms that underpin daily operations. At SES Secure, through our SaaS Escrow (also known as Cloud Escrow) Solutions, we’ve been addressing this challenge for over two decades.

The traditional Software Escrow model was originally designed to protect on-premises applications. ‘On-premises applications’ refers to those physically installed within a company’s infrastructure. However, as software delivery shifted toward cloud-based solutions overtime, the concept of Software Escrow evolved alongside it. Despite prevailing misconceptions that Escrow doesn’t apply to SaaS platforms, the reality is quite the opposite. Without a robust risk mitigation strategy in place, businesses relying on SaaS delivery could face severe consequences if their provider experiences a disruption or ceases operations. Such outcomes may include:

- Financial loss.

- Damaged stakeholder relationships.

- Reputational damage.

Our solution for mitigating against these risks is SaaS Escrow, a Software Escrow model that safeguards cloud-hosted critical applications.

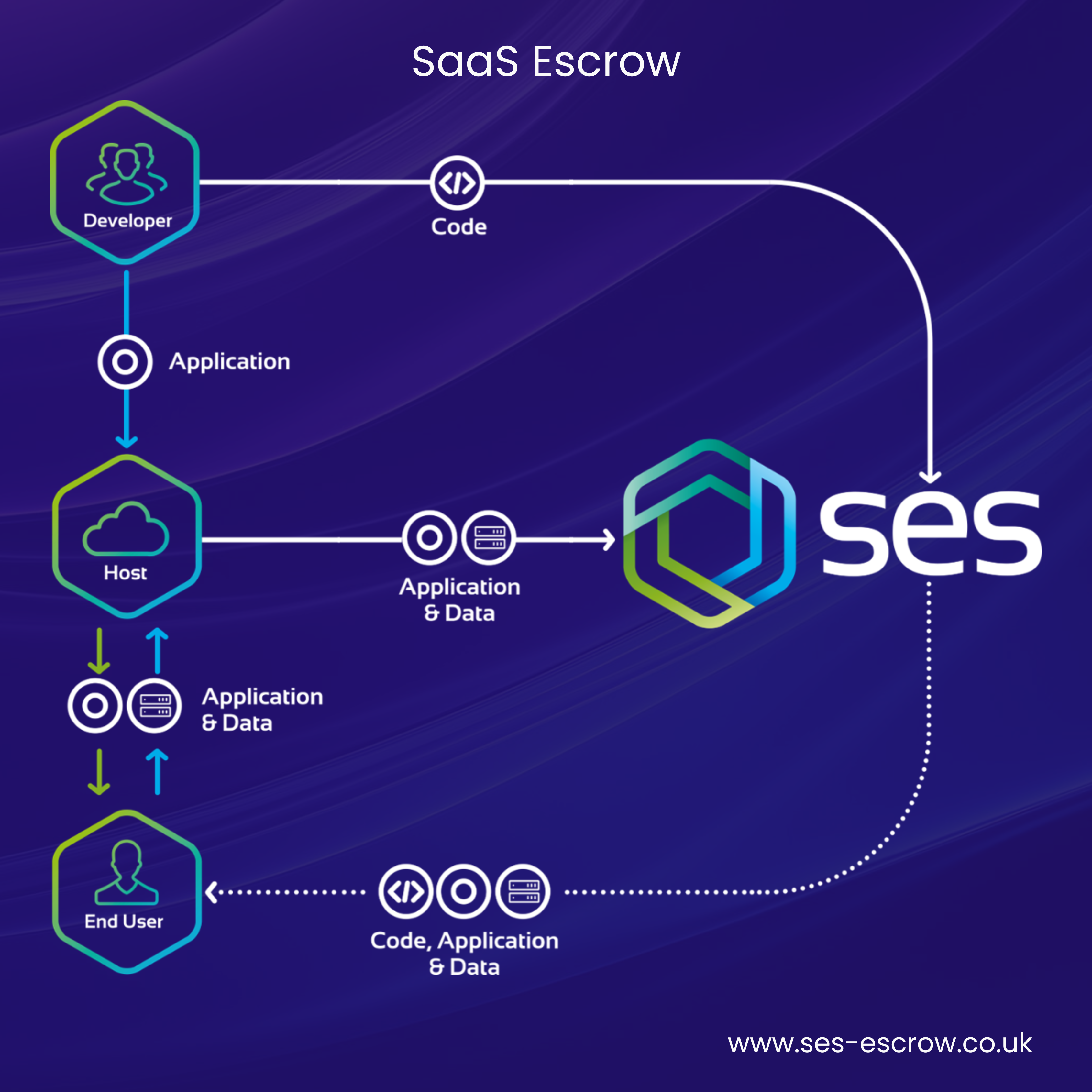

How Does SaaS Escrow Work?

SaaS Escrow is a legal and technical arrangement where a third-party Escrow agent, such as SES Secure, holds essential components of a SaaS application, typically source code, data, documentation, and sometimes even virtual machine images or deployment scripts. The aim is to protect the licensee (a software application’s end-user) by guaranteeing access to these assets if the provider can no longer deliver the service.

Here’s a breakdown of the typical SaaS Escrow process:

Agreement Setup: An agreement is set up between 3 parties. These being the SaaS provider (the licensor), the end user, also referred to as the licensee (typically a company), and finally a trusted Software Escrow provider.

Deposit of Assets: The provider regularly deposits updated source code, data backups, and other critical materials with the Escrow agent. This ensures that if these assets are to ever be released, the end-user has the latest version of the application available to them.

Verification: The Escrow agent may perform technical verification to ensure the assets are complete, accurate, and usable.

Release Conditions: The agreement defines specific "trigger events", also referred to as “trigger conditions” (e.g., bankruptcy, service discontinuation, breach of terms) that allow the end-user to gain operational access to the Escrowed materials.

Business Continuity: If a release is triggered, the end-user receives the assets and can deploy the software independently or with another provider.

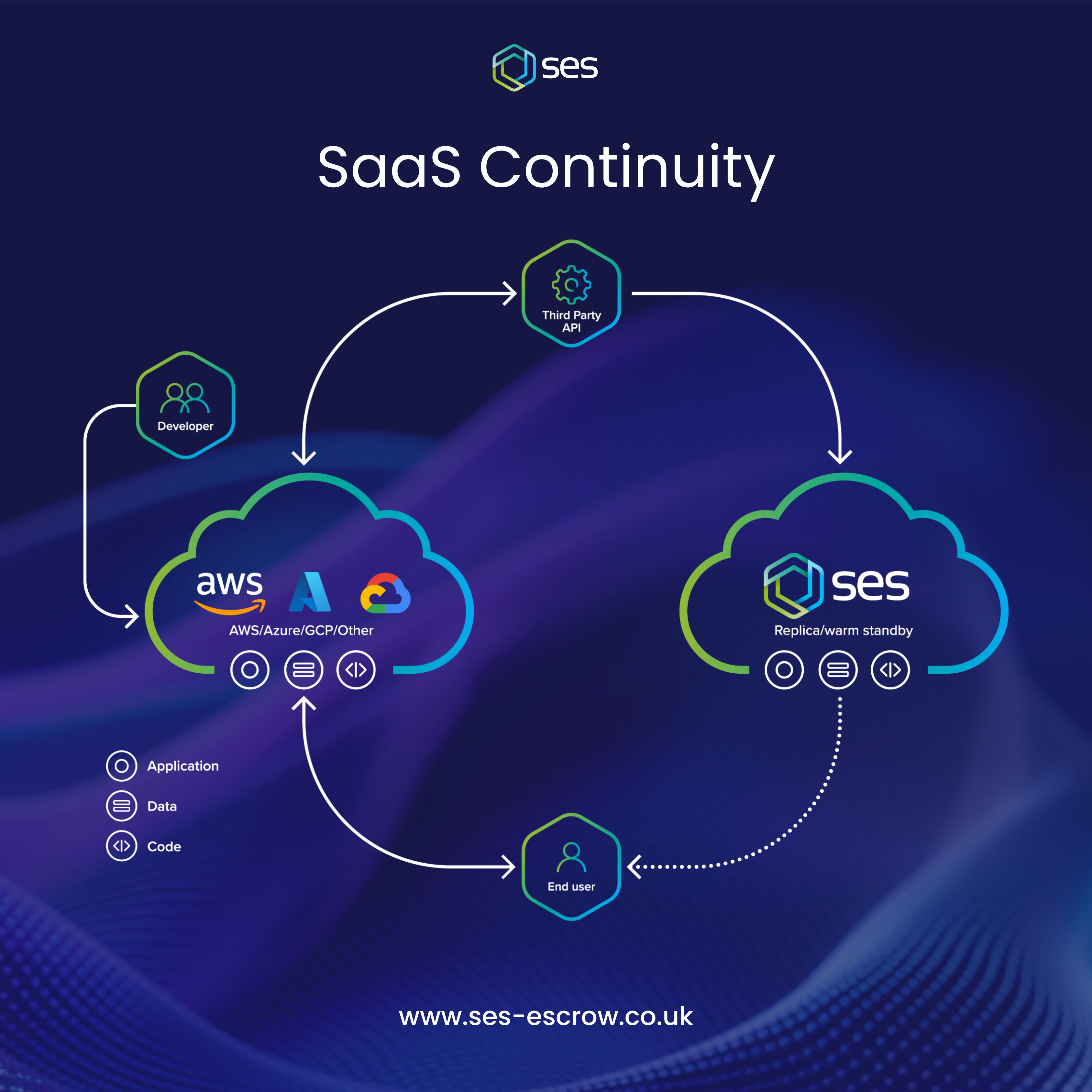

What is SaaS Continuity?

Launched by SES Secure in 2021, SaaS Continuity is a cutting-edge disaster recovery solution designed to protect mission-critical cloud applications with unmatched reliability. Purpose-built for the SaaS era, it ensures swift and seamless access to hosted services in the event of provider failure or infrastructure disruption.

One of its standout advantages is the hands-off convenience it offers clients. If activated, the SES Secure team takes full charge of restoring the operational environment, rapidly rebuilding the service to mirror its original state. From there, SaaS Continuity guarantees an uninterrupted period of service, giving businesses the confidence to operate without fear of downtime or data loss.

SaaS Continuity additionally offers the following benefits:

- Legal right for continued use.

- Secured source code and user data.

- No limits on code and data upgrades.

- Rapid deployment (independent of supplier).

- No Licensee resources required.

- Managed business continuity.

- Application hosting.

- No delay when accessing a recovered application.

- Live reporting.

Collaborate With SES Secure to Safeguard Your SaaS Platforms

At SES Secure, we’ve been delivering Cloud Escrow Solutions for over two decades. Our approach to each individual project is completely bespoke and personalised to cater to a client’s specific needs, preferences, and requirements. To see what our clients have said about their experiences with us, head over to our official Feefo page.

To schedule a free call with one of our experts, please don’t hesitate to get in touch.