Organisations turn to new Software Escrow providers for a wide range of strategic, operational, and risk‑management reasons. This blog takes a closer look at those motivations and shares key insights into why many businesses are now selecting SES Secure as their trusted Escrow partner.

Why Businesses Change Their Software Escrow Provider

After reviewing their existing agreements, many organisations choose to switch providers. The most common reasons include:

Reliability

Trusted continuity: Software Escrow is central to an organisation’s resilience strategy. Businesses naturally gravitate toward providers with a proven track record, strong reputation, and unwavering security standards.

Level of Service

Proactive communication and support: An Escrow agreement underpins a company’s recovery plan. Clear communication, regular updates, and expert guidance are essential, not optional. Negative changes in a Escrow provider's structure and/or quality of service may encourage organisations to look elsewhere.

Cost Efficiency

Fair and transparent pricing: Escrow pricing varies widely. When costs escalate or no longer align with business needs, organisations often explore more cost‑effective alternatives.

Bespoke Agreements

Custom‑built Escrow solutions: While some providers offer only rigid, standardised agreements, SES delivers fully bespoke Escrow structures tailored to each client’s operational and technical requirements.

Compliance & Regulation Changes

Alignment with new regulatory standards: As regulations evolve, so must Escrow agreements. When existing contracts fall short of new requirements, businesses look for providers who can keep them compliant.

Options for Rapid SaaS System Recovery

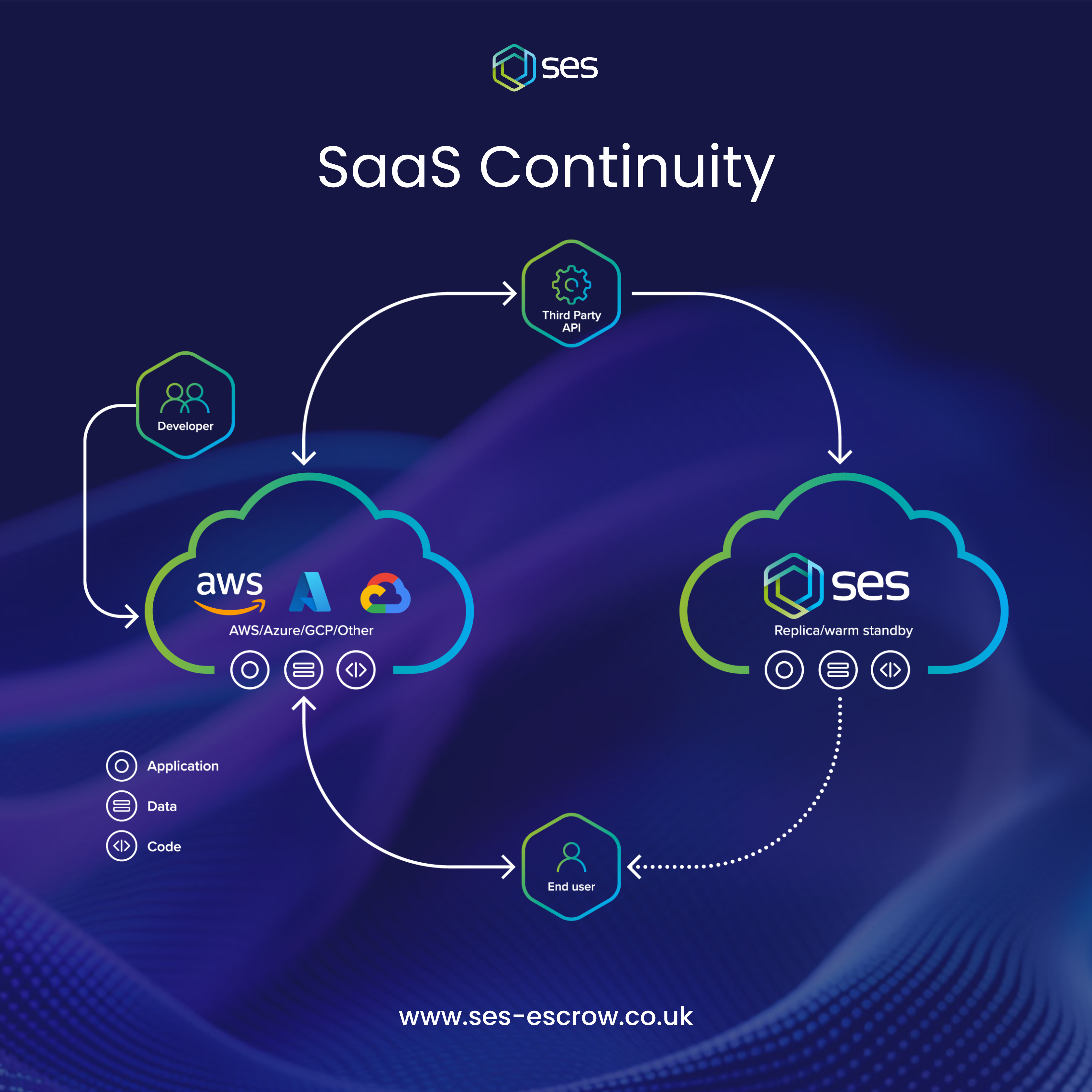

SaaS continues to evolve at pace, and with that shift, an increasing number of mission‑critical systems that organisations depend on every day now sit entirely in the cloud. When one of these essential SaaS platforms experiences a crisis or disruption, the consequences can be severe, from financial losses to operational downtime and long‑lasting reputational damage.

Although various SaaS recovery solutions exist, many share a common weakness: downtime. Traditional approaches often leave organisations waiting far too long to regain access to the systems they rely on. SaaS Continuity by SES Secure has been engineered to break that pattern. It offers a fundamentally different approach to recovery, one built around speed, certainty, and complete accessibility.

SaaS Continuity is purpose‑designed to ensure rapid, uninterrupted access to cloud‑hosted applications if the hosting environment or supplier becomes unable to deliver the service. It removes uncertainty at the very moment organisations need clarity and control.

What Sets SaaS Continuity Apart?

A standout advantage of SaaS Continuity is the hands‑on recovery support it provides. When activated, the SES Secure team takes full ownership of rebuilding the working service on the client’s behalf in a way that’s quick, accurate, and involves minimal disruption. Once restored, SaaS Continuity delivers a guaranteed period of service continuity, ensuring organisations remain fully operational while longer‑term decisions are made.

In short, SES Secure manages the entire recovery process end‑to‑end, giving clients confidence that their critical SaaS systems can be restored rapidly when it matters most.

To learn more about SaaS Continuity, check out our blog - SaaS Continuity – Disaster Recovery for Cloud-Hosted Applications

SES Secure Insights – Why Organisations Are Moving to Us

Businesses are increasingly transferring their Escrow protection to SES Secure for one simple reason: we make Escrow straightforward, innovative, and cost‑effective, without ever compromising on security or expertise. During onboarding, we discovered that 73% of incoming clients had incorrect or incomplete Escrow solutions, leaving their continuity and recovery plans unfit for purpose. We fix that.

With over 25 years of global experience, SES has refined Escrow into the smoothest, most efficient process in the industry. Every solution we deliver is tailored to the exact technical, operational, and regulatory needs of our clients.

At SES, we keep things simple. Our experience, technical expertise, and client‑first approach allow us to deliver cost‑effective solutions tailored to even the most complex environments

We proudly support over 3,000 clients across 46 countries, spanning government bodies, financial institutions, and global enterprises. . To see reviews from our clients, check out our official Feefo page where we have over 200 verified reviews.

Escrow Aftercare – The SES Secure Approach

Our support doesn’t end when materials are deposited. SES provides comprehensive aftercare throughout the entire lifecycle of your agreement, including:

- Full recovery assistance: If a release event occurs, our experts can manage the entire rebuild process. This is especially valuable for cloud‑hosted applications, where recovery is often more complex than on‑premises systems.

- Complimentary software asset review: We provide a detailed assessment and report to strengthen your continuity and recovery planning.

- Ongoing communication and guidance: We remain actively engaged, ensuring your Escrow protection evolves with your business.

Did You Know?

The Edinburgh Festival Fringe is the single biggest celebration of arts and culture on the planet. We partnered with the festival to help them transition away from an Escrow agreement that no longer met their needs. Please see the full case study to see how the process unfolded.

Here's what they had to say:

If you’re considering transferring your Escrow protection to SES, or want to explore how our solutions can strengthen your resilience, our specialists are ready to help. To speak with them, please get in touch.