We’re currently in an era of technology in which cloud computing is dominating the digital landscape. As a result of this, the traditional concept of Software Escrow is undergoing transformation and evolution.

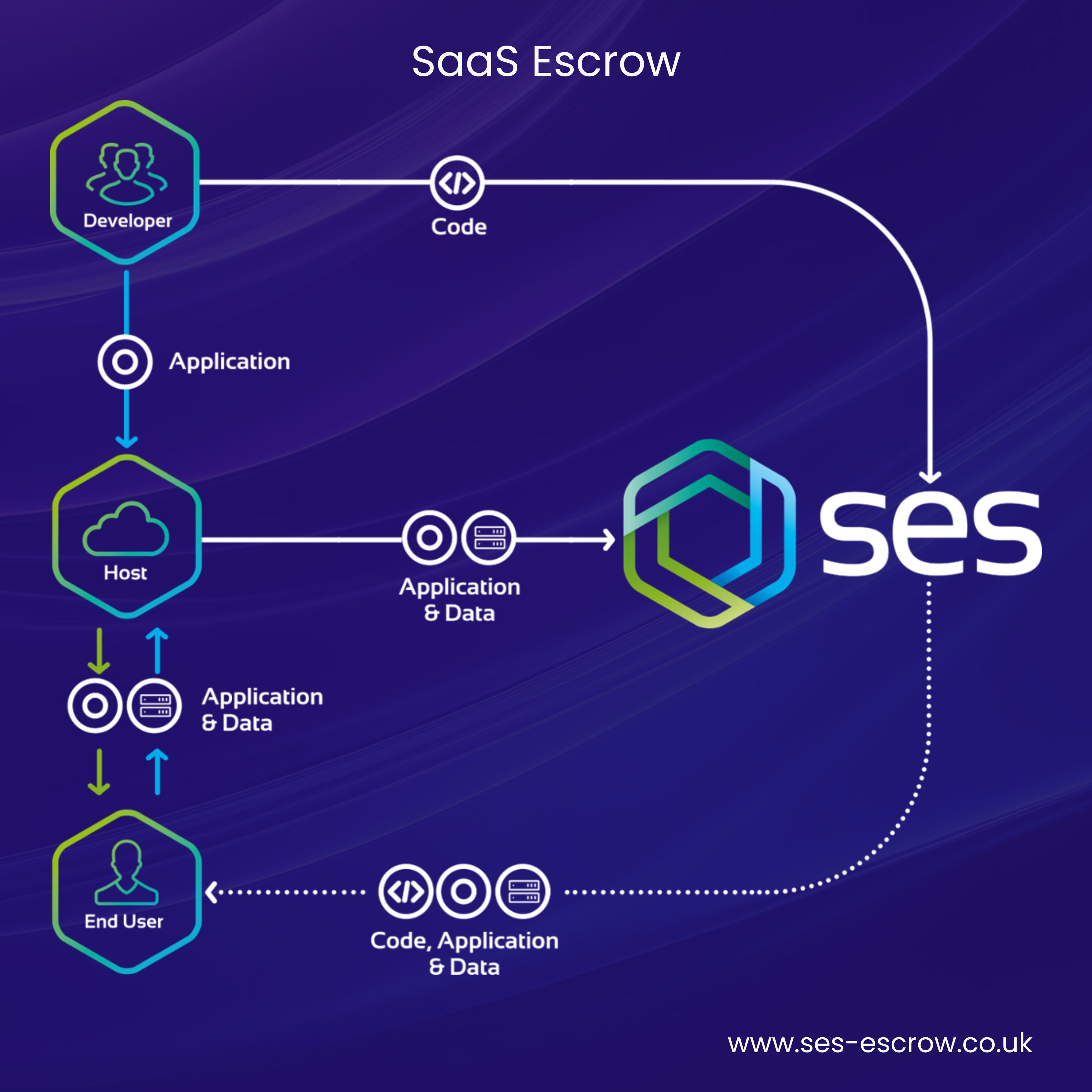

Accompanying the increasing popularity of SaaS services is the increasing reliance on SaaS suppliers. With that being said, it’s more important than ever for businesses to evaluate how they protect their access to critical software assets, including those that are cloud-hosted.

From On-Premises to Cloud-Hosted

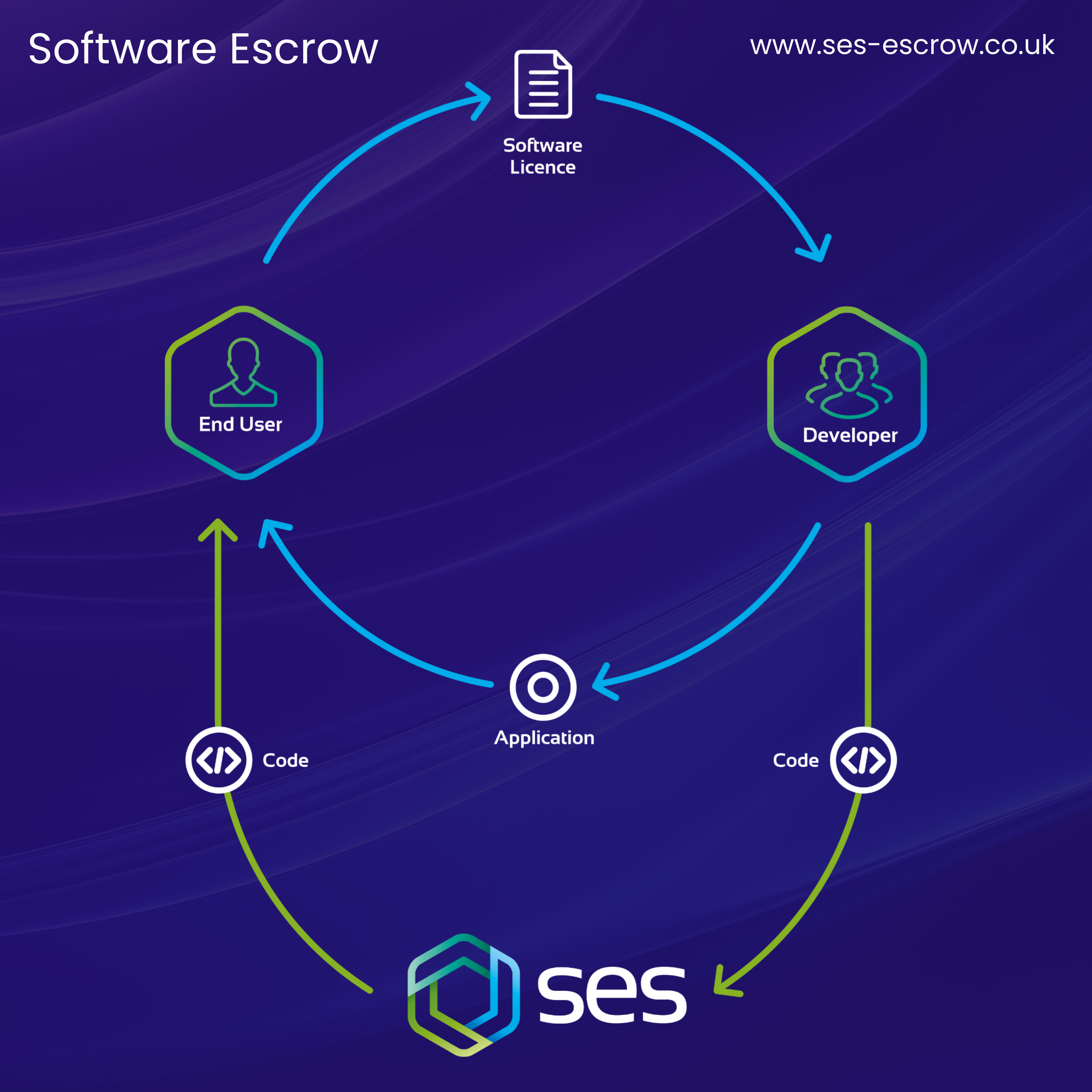

Historically, Software Escrow was used solely for safeguarding software assets that were physically stored within a business’s premises. This process involves a software developer depositing source code with a third-party Escrow provider. The Escrow provider then ensures that if the developer/supplier went out of business, faced maintenance issues, or failed to meet obligations, the client could still access and maintain the software.

In a cloud-first world, it’s become the norm for businesses to opt against installing software on local servers. It’s now a lot more common for businesses to store software assets within cloud-hosted environments which can be accessed via the internet. These environments are managed entirely by SaaS software vendors. Interestingly, this raises the question of…what happens if a cloud provider encounters problems?

The Evolution of Software Escrow

Software Escrow emerged in the 1980s, a decade marked by a surge in the popularity and reliance on software applications. As businesses increasingly depended on third-party software providers, concerns about continuity and risk management grew. In response, Software Escrow was developed as a safeguard to protect against vendor failure or other disruptions. Whilst Software Escrow was initially brought in to safeguard on-premises applications, it’s now evolved to also cater to the cloud-based software delivery model too.

At SES, we’ve been providing Software Escrow and SaaS Escrow Solutions for over 25 years. Within this time, the evolution of our SaaS Escrow services has seen us establish ourselves as a reputed and highly trusted SaaS Escrow provider, one that can support clients from all sectors with optimising the business continuity and operational resilience of their SaaS software assets.

The evolution of SES’s approach towards SaaS has also led to the creation of SaaS Continuity. Launched by SES Secure in 2021, SaaS Continuity is a pioneering disaster recovery solution that offers unmatched protection for critical cloud-hosted applications. Unlike traditional Escrow models, SaaS Continuity is purpose-built to ensure immediate and seamless access to essential services if the original hosting environment or provider becomes unavailable.

In the event of a service disruption, the SES Secure team takes full responsibility for rapidly rebuilding and restoring the application environment on behalf of the client. This hands-on approach eliminates the burden on internal teams and ensures minimal downtime.

Once activated, SaaS Continuity guarantees a defined period of uninterrupted service, giving clients the time and stability needed to transition or make long-term decisions without compromising business continuity.

Navigating the Future

For businesses, the key takeaway is that Software Escrow is no longer just about source code, it's also about service continuity. As cloud adoption grows, so too must organisational strategies for risk mitigation and operational resilience.

Whether you're a software vendor, enterprise client, or legal advisor, now is the time to revisit your Escrow agreements and ensure they’re fit for the cloud-first future.

To learn more, or to schedule a conversation with a member of our team, please get in touch.